Presentation GDI Insurance

GDI Protection can Discuss the features of a typical GDI life insurance policy, including the level premium, guaranteed death benefit, and potential for higher returns based on the stock market index .

GDI Protection can Explain the different coverage options available with GDI life insurance policies.

it can Discuss the different coverage amounts, policy lengths, and other factors that can affect the cost and coverage of a GDI policy.

While in principle back up plans could support interest in misfortune decrease, a few pundits have contended that practically speaking guarantors had generally not forcefully sought after misfortune control measures—especially Walk through an example of how a GDI life insurance policy works, including how the premiums are calculated, how the death benefit is determined, and how the potential for higher returns based on the stock market index works.

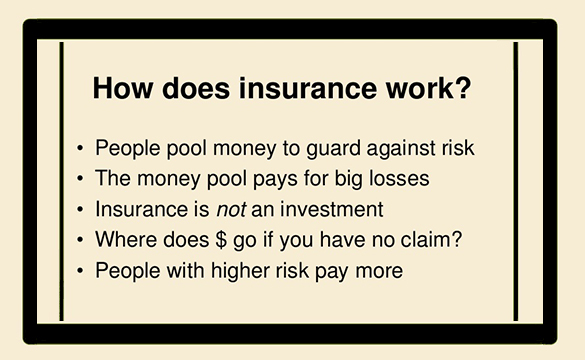

How does GDI Protection Functions

The back up plan and the protected get a legitimate contract for the protection, which is known as the protection strategy. The protection strategy has insights concerning the conditions and conditions under which the insurance agency will pay out the protection add up to either the safeguarded individual or the candidates.Discuss how to work with GDI insurance company to find the best policy for your needs.

Mention the importance of working with a knowledgeable insurance professional to understand the coverage options, premiums, and potential benefits of different policies.

Protection is a method for shielding yourself and your family from a money related misfortune. By and large, the premium for a major protection spread is a lot lesser as far as cash paid. The insurance agency goes out on a limb of giving a high spread to a little premium in light of the fact that not very many safeguarded individuals really wind up asserting the protection. Any individual or organization can look for protection from an insurance agency, yet the choice to give protection is at the watchfulness of the insurance agency. For the most part, insurance agencies will not give protection to high-chance candidates.